ADX Indicator in Trading: Strategy & Calculation

The indicator line on a 1-minute interval was below the 25% level for 5 hours. The price chart shows a clear narrow flat of fewer than 10 points wide at 4-digit quotes. Considering the spread on such a range, only scalping trading strategies will be effective. If the price is flat, then the oscillator line will be below the 20th level and move horizontally.

When the positive DMI reads above the negative DMI, this means that prices are increasing and this signals an uptrend. When the negative DMI reads above the positive DMI, this means that prices are falling and this signals a downtrend. ADX (Average Directional Index) is a unique indicator, which may operate ahead of schedule and show the trend strength (whether it will continue or decline gradually) before the price starts moving. On the chart, the main line of the ADX index is shown together with the DI+ and DI- curves.

What is the meaning of ADX indicator?

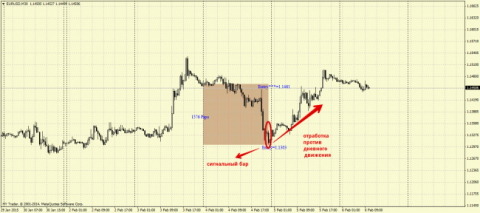

During the divergence, you can see the strengthening trend, its movement is getting more powerful – there are changes in the slope angle. The point that the arrow points to is where the +DI and -DI lines swapped. The direction is determined by the relative position of the +DI and -DI lines and their crossing. DM can be of either the M value calculated during the previous step or 0, depending on whether the algorithm condition is met. +M is an absolute positive price movement, -M is an absolute negative price movement. The -DI line indicates the strength of negative movement and is calculated by taking away the previous day’s low from the current day’s low.

International Holding Company PJSC (ADX:IHC) Shareholders Will Want The ROCE Trajectory To Continue – Simply Wall St

International Holding Company PJSC (ADX:IHC) Shareholders Will Want The ROCE Trajectory To Continue.

Posted: Sat, 17 Jun 2023 04:17:58 GMT [source]

The next time you think a trend is changing and you need to decide whether to stick to this “friend” or cut ties, consider trying the ADX to confirm the trend’s strength. One way to trade using ADX is to wait for breakouts first before deciding to go long or short. When you’re using the ADX indicator, keep an eye on the 20 and 40 as key levels. Miguel worked for major financial institutions such as Banco Santander, and Banco Central-Hispano. The ADX indicator equals 100 times the EMA of the absolute value of (+DI minus –DI) divided by (+DI plus –DI). Even though breakouts are not hard to spot, they often fail to progress or end up being a trap.

What to look for in strength readings?

These lines help traders decide whether to take a long or a short trade or hold back from making a trade at all. The sequence of ADX peaks is a visual indication of overall trend momentum, demonstrating when the trend is gaining or losing momentum – the acceleration of price. A succession of higher ADX peaks indicates trend momentum is rising. At the same time, a series of lower ADX peaks shows decreasing momentum. The two oscillators complement each other perfectly and compensate for each other’s weak points. The main index line has been removed to avoid making the ADX momentum chart look cluttered.

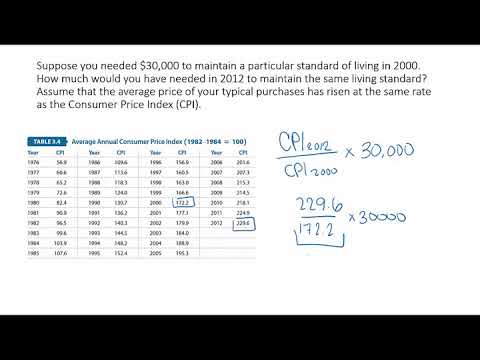

At its most basic, the Average Directional Index (ADX) can be used to determine if a security is trending or not. This determination helps traders choose between a trend-following system or a non-trend-following system. Wilder suggests that a strong trend is present when ADX is above 25 and no trend is present when ADX is below 20. To quantify the trend’s strength, the calculation of the Average Directional Index is based on a moving average of a price range expansion over a certain timeframe. Typically, the indicator is calculated for a 14-day period, although it may be implemented to any — including an hourly or weekly — chart. ADX calculations are based on a moving average of a price range expansion over a specific time period to quantify trend strength.

Weekly Finance Digest

The trend’s strength means how much the buying volume exceeds the selling volume or how much the selling volume exceeds the buying volume. If they are equal, the price is flat, and the main oscillator single line is reaching 0. If the order volume on one side rises sharply, the price starts moving upward or downward, and the indicator single line moves towards 100%. When interpreting the ADX reading, keep in mind that the oscillator is auxiliary.

- Typically, the indicator is calculated for a 14-day period, although it may be implemented to any — including an hourly or weekly — chart.

- Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses.

- ADX values range between 0 and 100, where high numbers imply a strong trend, and low numbers imply a weak trend.

- Today the traders should pay attention to the Retail sales in Canada.

Taking into account that the ADX line also shows a rise over the threshold of 25, it’s possible to say that the DAX30 index is in a strong uptrend. To calculate the ADX, you should first specify the positive (+) and negative (-) DM or directional movement. The +DM and –DM can be determined by calculating the “up-move” (current high minus the previous high) and the “down-move” (current low minus the previous low). The ADX is a lagging indicator, meaning a trend must have established itself for the ADX to generate a signal that a trend is underway.

Women Talk Money

Any time the trend changes character, it is time to assess and/or manage risk. Divergence can lead to trend continuation, consolidation, correction or reversal (below). The ADX requires a sequence of calculations due to the multiple lines in the indicator. We can also see that Bitcoin’s ADX has turned downwards from an exceptional high towards the end of January 2023.

What ADX value is bullish?

The ADX is read on the scale of 0-100; ADX trading above 25 value is considered as a bullish signal and below 25 as negative strength.

Volume-based indicators, basic trend analysis and chart patterns can help distinguish strong crossover signals from weak crossover signals. For example, chartists can focus on +DI buy signals when the bigger trend is up and -DI sell signals when the bigger trend is down. The ADX line is used to determine if an asset is trending or not. A strong trend is in place when ADX is above 25, so there’s a sense to use trend-trading strategies. Consequently, when the ADX is below 25, it’s better to avoid trend trading and choose an appropriate range trading strategy.

Average Directional Index (ADX)

A negative directional movement occurs when the prior low minus the current low equals greater than the current high minus the prior high. Supporting documentation for any claims, comparison, statistics, or other technical data will be supplied upon request. TD Ameritrade does not make recommendations or determine the suitability of any security, strategy or course of action for you through your use of our trading tools. Any investment decision you make in your self-directed account is solely your responsibility.

A falling ADX line only means that the trend strength is weakening, but it usually does not mean the trend is reversing, unless there has been a price climax. As long as ADX is above 25, it is best to think of a falling ADX line as simply less strong (shown below). You need to add together the ADXR period https://traderoom.info/xcritical-review/ and offset to get the offset to use for past values of ADXR however. The 10 period ADXR of the 14 period ADX for the previous bar would add 1 to the offset parameters for the formula used for the current value. In a volatile market like cryptocurrency, ADX can be an important tool for investors.

What does ADX stand for?

The average directional index (ADX) is a technical analysis indicator used by some traders to determine the strength of a trend.

What is Capital Adequacy Ratio? Definition of Capital Adequacy Ratio, Capital Adequacy Ratio Meaning

This means that the implications of the leverage ratio for trade finance may not yet be visible. What is regulatory capital in a bank and how much regulatory capital is needed for a given class of banking business is subject to negotiation and discussion with the regulator. So just in case, the regulators have further proposed the leverage ratio as a non-negotiable backstop. The leverage ratio is there to make sure that there is a simple overriding test in the background that no bank can easily work around.

Any framework is robust only when it is modified to address new challenges and risks. Many banks considering the implications of Basel 3 have reduced the scope of trade finance services that they provide, or have even pulled out of trade finance altogether. But if the LC is weighted 100%, then 5 times as much capital has to be committed. This makes the returns look low relative to alternative uses of the bank’s credit lines and capacity; banks do not really want to do LCs on this basis. But, as mentioned above, different types of activities have different weightings in the calculation – called a “credit conversion factor” or CCF.

Balaji is involved with research and fund management at ithought. Bank regulations cover many things – but one of the main requirements is that banks put up “capital” to absorb the credit and other risks that they take. This requirement protects you, me and other ordinary depositors from the risk of losing our money. Capital is the shareholders’ money , and additional money that is specifically raised by the bank which takes any losses before depositors if there are problems.

Income Tax Filing

The solution was to authorize the banking regulator of each country to implement these rules. A new “leverage ratio” that acts as a backstop to all the capital calculations. Banks are regulated because they usually take deposits from ordinary people and must not be allowed to act recklessly with the deposits that they take. Regulations exist principally to protect depositors, and because banks can become systemically important in the economies where they operate. Banks have to maintain a certain portion of deposits with the central bank. It is called the Cash Reserve Ratio and is typically around 3%.

However, as per RBI norms, Indian scheduled commercial banks are required to maintain a CAR of 9% while Indian public sector banks are emphasized to maintain a CAR of 12%. Banks hold more capital than required due to various motives. Myers asserts that adding new equity may transfer value to fixed income claimants, as in a “debt-overhang” situation. However, when the transaction cost reduces, then firms raise the funds through external equity finance .

Further you can also file TDS returns, generate Form-16, use our Tax Calculator software, claim HRA, check refund status and generate rent receipts for Income Tax Filing. ClearTax offers taxation & financial solutions to individuals, businesses, organizations & chartered accountants in India. ClearTax serves 1.5+ Million happy customers, 20000+ CAs & tax experts & 10000+ businesses across India. Additional requirements for systemically important banks, including additional loss absorbency and strengthened arrangements for cross-border supervision and resolution. With an attempt to further enhance the limited scope of the Basel I accord, a revised framework was introduced by the committee in 2004.

The consultation includes a 1-hour session with a financial planner to understand your objectives and needs. Following this, you will receive a quotation for the financial planning services. However, it can be adjusted against the financial planning fee assessed based on the scope of work. Susithra has also completed the CFA Level 1 exam and level X Investment Advisor exams from NISM. An avid reader, she is passionate about personal and behavioral finance.

Urban co-operative banks having deposits up to ₹100 crore have been classified as tier-1 UCBs. The second tier incorporates co-operative banks with deposits more than ₹100 crore and up to ₹1,000 crore. RBI has implemented these guidelines in the country to make bank’s regulation and compliance process in par with the other world banks so that Indian banks remain in a strong position to absorb any financial risk. The measures aim to strengthen the regulation, supervision and risk management of banks. Roshan acquired a bachelor’s degree in BCom with specialization in Finance and Accounting from Vivekananda college prior to working with us.

What is the Basel committee on Banking Supervision?

This guide will help those without previous knowledge to understand the new capital regulations on banks and the specialists to master the more obscured areas from the microscopic details given by the author. The book is a pleasure to read due to the numerous practical examples marking the difference with other books on this topic. Opens up a peerless perspective on how different elements affect a bank’s regulatory capital.

What is in Tier 2 capital?

Under the generally applicable rule, tier 2 capital includes the allowance for loan and lease losses (ALLL)3 up to 1.25 percent of risk-weighted assets, qualifying preferred stock, subordinated debt, and qualifying tier 2 minority interests, less any deductions in the tier 2 instruments of an unconsolidated financial …

It is an international regulatory accord that introduced a set of reforms designed to mitigate risk within the international banking sector. The increase in CRAR requirement is reasonable as these UCBs do not have full capital charge for market risk and currently maintain no capital charge for operational risk, the central bank says. Juan Ramirez has written an excellent book on Basel III capital. It is an excellent handbook going a long way to filling a gap in the literature available on capital adequacy.

Why are banks regulated?

Capital adequacy quickly became the major focus of the Basel Committee’s efforts when the foundations for supervision of globally operating banks were built. The minimum capital requirement was fixed at 8% of risk weighted assets . Under Basel III, the minimum total capital ratio that a bank must maintain is 8% of its risk-weighted assets , with a minimum Tier 1 capital ratio of 6%. The rest can be Tier 2 capital.Risk-weighted assets are used to determine the minimum amount of capital that must be held by a bank, by assigning risk levels to each type of asset. In the case of Dhanlaxmi Bank, the write-down and reclassification of tier-2 bonds in the next few months is expected to adversely affect the bank’s capital adequacy ratio.

He has a wealth of experience in the financial services industry. Amit has spent more than two decades working with banks, asset management companies , and financial advisory firms. His value systems in client service are closely aligned with ithought’s and he joined us in 2015. Gaurav is a qualified Chartered Accountant with 7+ years of experience in capital markets, personal finance, auditing and taxation. He has been with ithought for the last 5 years and is currently part of the PMS team and assists the CIO in managing the company’s Solitaire Fund.

What were the main changes in Basel 3?

Traditionally, it refers to the risk that a lender may not receive the owed principal and interest. This exposes the bank to a variety of risks of default and as a result they fall at times. The committee expanded its membership in 2009 and then again in 2014. The BCBS now has 45 members from 28 Jurisdictions, consisting of Central Banks and authorities with responsibility of banking regulation.

- Under Basel-III norms, banks are supposed to maintain their capital to risk weighted assets ratio at 9% or above.

- Here Tier I capital is a bank’s core capital consisting of shareholders‘ equity and retained earnings; while Tier II capital includes revaluation reserves, hybrid capital instruments, and subordinated term debt.

- In Basel III norms, the Tier 3 capital has been eliminated.

- The capital requirements are adjusted according to prevailing market conditions.

- Balaji is a passionate equity investor with 14 years’ of experience in financial markets.

The impact of excess capital in banks is examined through a partial adjustment approach with unbalanced panel data for listed Indian banks from 2006 to 2017. Findings reveal that banks hold excess capital ratios, and private sector banks actively manage higher capital ratios than the public sector banks. The speed of adjustment for private banks is much higher than for public sector ones, and an inverse relationship between non-performing assets and change in equity capital is found. Following Basel-III norms, central banks specify certain capital adequacy norms for banks in a country. The risk weighted asset refer to the fund based assets such as cash, loans, investments and other assets but their value is assigned a risk weight and credit equivalent amount of all off-balance sheet activitis. The material impacts on trade finance and letters of credit arise from the consolidation of previously off-balance sheet items into the capital charge, and via the leverage ratio.

The draft regulations proposed raising common equity in tier-1 capital to 5.5% of RWA and proposed the minimum tier-1 capital at 7%. Capital distribution constraints will be imposed on an AIFI when capital level falls within this range. However, they will be able to conduct business as normal when their captial levels fall into the conservation range. “Therefore, the constraints imposed tier 3 capital are related to the distributions on AIFIS when their capital levels fall into the range increase as the AIFIs’ capital levels approach the minimum requirements,” it noted. Googletag.cmd.push(function() ); Common equity consists of paid-up equity capital, share premium, statutory reserves, capital reserves, balance in poft and loss account and other disclosed free reserves.

According to RBI, the AIFIs shall implement all three pillars of Basel III captial regulations, considering their role in the Indian financial system. AIFIs are required to maintain a minimum pillar 1 capital to RWA of 9% on an on-going basis other than capital conservation buffer and counter-cyclical captial buffer. Capital Adequacy Ratio is the ratio of banks capital to risk-weighted assets .

TaxCloud (Direct Tax Software)

The more capital that is needed, the less attractive the business becomes. The more capital that is needed, the higher the rates and charges that the bank will want to impose. Basel 3 proposes an unattractive capital treatment for the issuance of letters of credit relative to Basel 2 and relative to the treatment of other types of banking business. Remember the CAR formula, it is calculated as the ratio of Bank Capital to Risk Weighted Assets.

It represents the amount of capital that allows a bank to absorb losses without affecting the interests of depositors. Tier 1 capital consists of shareholders’ equity and retained earnings. Even though the Basel norms are not mandatory in nature, they form the backbone of the risk management structure of banks worldwide.

What are the 3 pillars of Basel 3?

The three pillars of Basel III are market discipline, Supervisory review Process, minimum capital requirement.

During his time here, he has developed a keen interest in value investing and financial planning. He is known for his warmth and is committed to client service. Ajay is also a professional cricketer and is passionate about traveling.

What is in Tier 1 capital?

Tier 1 capital represents the core equity assets of a bank or financial institution. It is largely composed of disclosed reserves (also known as retained earnings) and common stock. It can also include noncumulative, nonredeemable preferred stock.

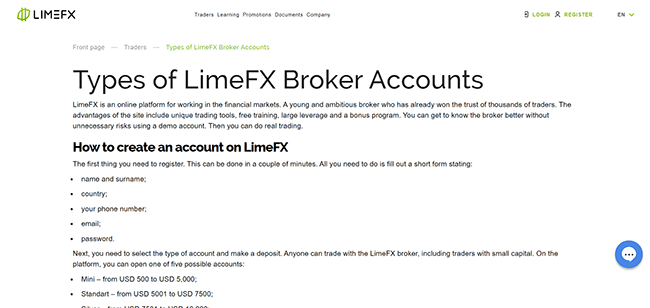

LiteForex Review Forex Broker for Everyone

Contents

We rate brokers overseen by the St. Vincent & the Grenadines Financial Services Authority as unregulated. When choosing a broker, trustworthiness is one of the most important things to keep in mind. Always check the broker’s regulations, know how financially secure the firm is, and find out whether the broker is transparent and reliable. These factors, calculated into our score, will help you understand if your money is safe.

Knowing if a company resolves problems or not is very important information to potential clients. The company works properly, I do not see any problems here, the broker for trading is quite decent. I have recently started to trade with this company again, everything is on a decent level as always. I advise this company for professionals, unfortunately for beginners it does not work. I have always traded well here, and I have never had any problems with finances.

Does LiteForex Have an Educational Section?

LiteFinance Global is incorporated in St. Vincent & the Grenadines. The European entity of LiteForex is headquartered in Limassol, Cyprus, and is regulated by the Cyprus Securities and Exchange Commission . LiteForex caters to beginner traders by providing them with extensive educational material in their comprehensive education centre. Traders have access to a Forex glossary, eBooks, tutorials, trading strategies, trading indicators, and a blog with loads of helpful information. In addition to the educational resources, traders also have access to an economic calendar, analytics, various financial calculators, economic news, and currency rates. All in all, traders at LiteForex are given everything they need to succeed.

The clients can choose from options such as Yandex, Alipay, and Dengi. The broker offers its services at a minimum deposit of $50, and all payments are usually processed within 24 hours from the request time. Clients can use cryptocurrencies such as Bitcoin to add money to their accounts. Every financial transaction made with the broker must be above a $10 deposit. For bank deposits/wire transfers, the minimum deposit should be at least $100. As a registered financial service provider, LiteForex LimeFxs Limited offers a plethora of tools and brokerages to its clients.

What are the opinions about LiteForex?

It undoubtedly speeds up the withdrawal procedure and ensures instant receipt of funds. The broker doesn’t charge commissions for replenishment and withdrawal of funds. Moreover, the company reimburses the commission paid by the user to the payment system when replenishing the account. https://limefx.group/ OnlineForex.biz provides news updates and educational information regarding Foreign Exchange trading. OnlineForex.biz works also as an Introducing Broker to the best Forex Brokers around the world. This service is 100% free, as we get paid only by Forex brokers and never by traders..

The Forex ECN trading account from LiteForex is for professional experienced traders as well as investors and traders who wish to use the Social Trading service. Forex Trading Platform and Financial Asset Management Institution LiteForex have 4 different account types. Every Forex trading account type has different features and conditions with LiteForex. I have been invited to this limefx forex broker company by my acquaintances to earn on LimeFxs, I have opened several accounts to which I copy trades of other traders. My earnings are not so good yet, but after 3 months of work I’m not very much nervous about it. More than 10 years of successful work with traders around the world, favorable terms of trade, recommendations from grateful users prove our point of view.

As LiteForex is based in the Marshall Islands, they are licensed and regulated in accordance with the Marshall Islands Business Corporation Act. Therefore, the brokerage is trusted to provide safe, secure, and transparent online trading services limefx courses scam and has been doing so for over 13 years. LiteForex is an online broker offering its services to customers from different parts of the world. As a company, LiteForex was founded in 2005 under the title LiteForex LimeFxs Limited.

How many days do deposits take with LiteForex?

Both MT4 and MT5 trading platforms have been globally recognized as effective trade tools. MetaTrader 4 is being offered by LiteForex since web-based platforms through the WebTrader interface. To facilitate mobile trading, these platforms are also available as a mobile app, allowing clients to start investing at their convenience.

- If the margin requirement to maintain open positions is less than the amount of bonus funds, the Stop Out will occur as soon as the equity level reduces to the margin requirement level.

- LimeFx counters with an average commission-free cost of 1.1 pips or $11, while the DMA account shows a minimum spread of 0.1 pips for a fee of $6 per lot.

- You can download MetaTrader 4 in the “Trading Platforms” section of the broker’s website.

- The broker doesn’t charge commissions for replenishment and withdrawal of funds.

- There is an in-depth collection of articles for beginners, covering topics ranging from basic forex concepts to risk management and creating a trading strategy.

In this section, we check the broker’s market offering and how varied the instruments and asset classes are. It will allow you to check if they offer what you’re looking for and what you can trade. MetaTrader 4 allows users to develop, test, and apply Expert Advisors .

Disregarding the problem with phone support, we rated the customer support experience at LiteForex as good. Signals in MetaTrader 4 allow users to copy the activity of other traders automatically. LiteForex offers MetaTrader 4 and MetaTrader 5 for desktop.

Does LiteForex allow scalping and news trading?

You can download it on our site.In the first place, we boosted the app’s operating speed. Here, too, lead their trade, while no trabble, withdraw the money, support is responsible, but with web.mane some problems were, the other payments norm all. It’s good for me and I know traders who also have accounts here, no one is complaining. I have been trading for three months, the flight is normal, the broker does not drizzle and does not worsen the conditions, the servers are stable. There are no questions about finances, transfers are fast, commissions are acceptable. LiteForex is registered in the Marshall Islands, so it’s subject the legislation of this country .

In our tests for the Trust category, we also cover factors relating to stability and transparency. Here, we focus on how long the broker has been in business, the size of the company, and how transparent they are in terms of information being readily available. LiteFinance Global LLC is incorporated in St. Vincent & the Grenadines as a Limited Liability Company with registration number 931 LLC 2021.

All in all, if you’re looking for a reliable online trading brokerage to trade forex and other financial assets, LiteForex could be the broker for you. According to the client reviews, LiteForex clients can top up their funds directly into their accounts using their credit cards or debit cards. Online payment gateways and wallets such as Skrill, Neteller, CentrePay, and WebMoney are also available to deposit money instantly.

Deposits/withdrawals and chat support are also available via the app. LiteForex outlines spreads and swap fees in the Trading Assets section. Withdrawal fees are displayed in the finance section of the client portal. There is little information about the management or the company’s history on the website.

Review

I study with Alexander, the lecturer is very smart and everyone praises him. In my opinion, the company is very up-to-date and has all the services that traders need. In my opinion, the company is very modern and has all the services a trader may need. There is also a copy service for those who want to get passive income. I decided to leave a review because the broker is very good for all its services and trading quality, I recommend the company and the finances by the way there is complete order. It’s worth noting that LiteForex has been ensuring stability and reliability of Forex trading for many years.

LimeFx Forex Trade Platform and Broker Review

All commissions entirely depend on the payment systems that customers use. Besides, if the commission was from the payment system, we will compensate it. All information about this everyone can read on the LiteForex website in the deposit / withdrawal section.

Stock Market Chat Rooms

Contents

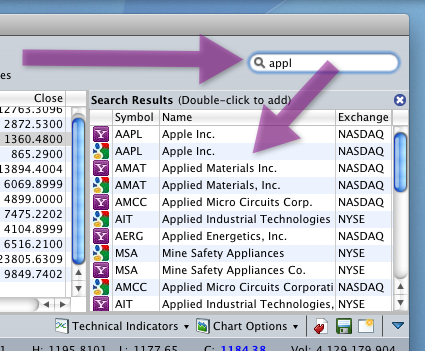

Warrior Trading is a robust educational resource for traders featuring tools, courses, and active trading chat rooms. Trade Ideas caters to day traders who want to find the best trades using real-time data. The service pays attention to every publicly traded individual stock and exchange-traded fund . You can ask questions about your stocks and get answers back in real time. By using our screen sharing software you can get your chart questions answered live during the trading day.

And so if you’ve been looking for a way to trade without indicators then you probably need to give thought to what the Day Trading Academy platform has to offer. One of the moderators is his millionaire students Michael Goode who is also an active trader with some great calls, especially during the day. Unlike Tim who is not very active during the day, you will always find Michael around. If you are looking for a day trading platform, we recommend checking outSpeedTrader. As its name suggests, SpeedTrader is a lightning-quick platform perfect for those looking to make a living day trading. Once you see the interface of this service, the name starts to make sense.

Bear Bull Traders is a community filled with serious traders from around the world who trade in the U.S. stock market. Stock chat rooms are archived, so when traders jump into a discussion, they can see what has already been talked about and how long ago comments were made. The most recent chats—where users have added comments within the last few minutes —are displayed at the top of the list. Anticipating market direction and sentiment is a key factor for a trader. Our Director of Education specializes in determining such factors and evaluates trading ideas relative to the market.

- With TC2000, you can also improve your technical analysis capabilities beyond your imagination.

- So especially if you have a full-time job outside of trading, it can help to have a way of sourcing trade ideas.

- ShadowTrader does also have support for stock traders and futures traders.

- You get to ask questions to seasoned traders and even answer some for complete beginners.

Though access to the trading room can be obtained free of cost, there are subscription charges to access the Trade Ideas platform and its tools. Stock chat rooms are online communities focused on discussing stocks and trade ideas specifically, and investing broadly. Popular topics will depend on the stock chat room—some will be flush with swing trading ideas, while others will include more discussions about long-term investments. You’ll also find different mixes of experienced traders and people who are newer to stock trading. As far as Trade Ideas’ day trading chat room is concerned, you can meet and discuss trade ideas and strategies. He is a veteran day trader who helps you understand how to make the most of the Trade Ideas.

More importantly, you have to gain enough knowledge or piggyback enough winning plays to make the upfront costs a worthwhile investment. With variety in mind, StockTwits Premium Chat Rooms have something for everyone. Extremely affordable, subscriptions are priced from $7.99 a month to $100 a month, although most options fall somewhere in between. Motley Fool and Seeking Alpha land in the middle in terms of price, and both offer several useful features. Seeking Alpha Premium’s proprietary quant records have an impressive track record leading to massive market outperformance.

Daily & Weekly Watch Lists

OTC trading chat room is one whose activities vary based on the market activity. For instance, when there is little going on in the OTC market, you won’t spot major activities in the chat room. Here, you will find moderators that are accustomed to OTC trading such as oil gusher, OddStockTrader, and bbstock.

So especially if you have a full-time job outside of trading, it can help to have a way of sourcing trade ideas. Through chat rooms, you can debate ideas live or look back at archived discussions whenever it’s convenient for you. In addition to chat rooms, TradingView offers other features, including excellent charts and screening tools. Even Basic users can screen stocks, mutual funds, ETFs, closed-end funds , foreign exchange , cryptocurrencies, and more. You can screen with pre-built fundamental and technical sets, or use pre-built screens such as Large-Cap, High-Dividend, Most Volatile, even Largest Employers.

Take it Further with The Trading Psychology Mastery

And don’t worry, we’ll breakdown everything you need know about stock chat rooms. From free subscriptions to fee paying options, this comprehensive guide has all the details before you sign up. Ironically, this is the best chat room I’ve been a part of and it’s the best one I’ve ever used and its 100% free.

In my Bulls On Wall Street Review, I cover my experience with the service, my review of the chat room, and my thoughts on the bootcamp. Before you dive in, read our review of Madaz Money and see if this is the right chatroom and community for you. Trading Review’s mission is to help you become a better and smarter trader/investor through in-depth reviews of courses, trading software, and more. Their tailor-made course can be broken down into 3 phases namely the beginner, intermediate, and advanced phases. And if you feel you have what it takes to hang out with the pros, you can always apply for the Pro Phase which is availed exclusively to a select few traders. Let’s face it – even the best-made trading indicator may fail.

Newbies can join this stock chat room to learn how to day trade or swing trade the market in a whole new way. Our options and futures trade room contains diverse trading strategies focusing on stocks, options, and futures. You can use this room to chat and bounce-off trade ideas and paper trade. We have people discussing different long-term plays as well as short-term strategies.

Dekmar Trades Review – Is Sean Dekmar Legit or a Scam?

But learning is a very individual thing, everyone learns at a different pace, and in different ways. Click Here to learn more about the private trading group and join. No two chat rooms will be the same, nor will their strategies.

Our eBook and candlestick courses are helpful guides on teaching you price action. The more you look at patterns, the more that these patterns will jump out at you. The Bullish Bears Discord is custom-built with some of the industry’s leading scanners, tools, and Discord bots.

If your guru offers premarket plans on a live stream, and has this archived, take advantage of it. Study in your free time by replaying their premarket video feed for a particular day, and then replaying the exact same market day in TradingSim. Document what worked, what didn’t work, and take annotated screen shots of your “categorized” setups and put them in a folder.

These are invaluable if you are serious about https://forex-trend.net/ and making money. I’ve been with Spartan Trading for several months and it has been a great supplement income in retirement. There is no better way to learn day trading than listening to others’ experiences. You will find many experienced day traders in chat rooms and learn a lot from their advice and ideas.

Share The Full Post

It has a retro, blacked-out look to it, and it looks pretty nice at that. Of course, the important thing is the https://topforexnews.org/, which includes an advanced stock scanner and charting tools. Black Box Stocks is a trading community with a chat room and Discord, plus free education, private Twitter groups, and more. Premium Plan ($228/month $2,268/year)– Includes access to 20 charts, 20 price alerts, AI robo-advisor Holly, and access to Brokerage Plus. To learn more about Benzina Pro, read ourBenzinga Pro review. Let’s get right to it and dive into the best chat rooms for stock trading.

However, most paid https://en.forexbrokerslist.site/ rooms require monthly or annual subscriptions. Because some services only offer the chat function and others have it as part of a more comprehensive platform, prices can vary greatly. If you ask a question in a chat room or on a message board, chances are someone is going to respond.

Economic Calendar Forex Trading Calendar

Contents

The Economic Calendar is a key tool to identify important economic events or data releases that can move the currencies and other instruments. They list the event along with its relevancy or impact on the asset. The Economic calendar will help you prepare from minor to major news events and control risk in your Forex trading. Each and every economic event is labeled with an impact from no-impact to low, medium and high impact as well as the previous, consensus and actual result. You can filter out the events by currency to match your trading.

If you do not care about macroeconomics when trading, it’s still a useful tool. It’s the most complete, accurate and timely economic calendar in the Forex market. We have a dedicated team of economists and journalists who update all the data 24h a day, 5 days a week.

Big news events can, and often do, cause big swings with a single movement going several percent in one direction. Daily Market Analysis Markets news and insights from our expert team to help you make those important trading decisions. Once you click on the event that interests you, you’ll have access to more information as well as a price chart showing historical data to help you decide if and how to act. If you use a VPN service, make sure you are connecting from the country that is authorized for fbs.com services. At the top of our Forex trading calendar, choose the most convenient time zone.

Bloomberg Daybreak Asia

The primary objective of the ECB’s monetary policy is to maintain price stability which is to keep inflation below, but close to 2 percent over the medium term. In times of prolonged low inflation and low interest rates, ECB may also adopt non-standard monetary policy measures, such as asset purchase programmes. The official interest rate is the Main refinancing operations rate. In case the news is negative, i.e. its value is lower than the forecast median a decision can be made to sell the currency, the quotes of which are most sensitive to the macroeconomic news content.

- Seems like a simple fix and it would make tracking my account so much easier.

- If the impact is low, the price of the relevant currency is likely to be unaffected.

- They reflect the impact the particular indicator had or is going to have, either positive or negative.

- Values before the actual data is released, but be careful – forecasts are always preliminary and actual figures might be drastically different.

- In the country of your residence you should register an account with RoboMarkets Ltd .

- From basic trading terms to trading jargon, you can find the explanation for a long list of trading terms here.

The United Kingdom has the sixth-largest national economy and its monetary policy is watched by the Bank of England, whose Governor is Andrew Bailey. Its capital, London, is the second-largest financial center in the world, behind only New York. Exinity Limited is a member of Financial Commission, an international organization engaged in a resolution of disputes within the financial services industry in the Forex market.

The US economic calendar is the most important one since the country is the largest world economy. The most important indicators mainly impact the price of the dollar, having important effects in other markets and currencies. You can filter dates by day, week or month to see exactly what’s happening and when. With the time frame you choose, you can also customise to check out the latest on the countries or economic events you’d like to monitor. At RoboForex, we understand that traders should focus all their efforts on trading and not worry about the appropriate level of safety of their capital.

The economic events calendar also shows the time and date of when the indicator data was released, the currency that they are expected to affect, and each indicator’s impact level. Most indicators have numerical values, which may be expressed as a percentage or as a currency value. They reflect the impact the particular indicator had or is going to have, either positive or negative. Clients and prospects are advised to carefully consider the opinions and analysis offered in the blogs or other information sources in the context of the client or prospect’s individual analysis and decision making.

Determine a trading position’s profits or losses at different market prices. Look out for the flag icon that represents the county of that particular data release, so can keep an eye on currencies that might be affected with just a quick scroll. In New Zealand, the business confidence index is designed to provide a snapshot of business opinions regarding the expected future state of their business and economy overall. The Net index is calculated by subtracting the percentage number of businesses that expect that the economic situation improves from the number that expect decline. My only complaint is that you cannot change what the widget and chart shows you. You can only see %gain when I want to see how much $ money I have made from each account everyday.

Not only can this help you to spot new opportunities, but also allows you to prepare and protection any existing positions should the markets take a turn for the worse. The importance of the news, namely, the impact on the relevant asset. If the impact is low, the price of the relevant currency is likely to be unaffected. On the other hand, if important news is published, there will be high volatility in the financial asset. The Bank of Canada runs ahead of its major rivals both in terms of the calendar and arguably in terms of policy shifts. This meeting may mark the beginning of the end of rate hikes, so loonie traders will be watching closely.

United Kingdom

The items are automatically updated to provide you with the latest information that could effect products that you trade. Furthermore, if you’ve missed an item , check the history of the forex news calendar to see all previous events and how they may have effected your trading products. An economic calendar is a tool that helps you keep up to date with major economic indicators, news and alerts as soon as they happen. It is automatically updated every time new information is released, and is a popular way for both fundamental and technical traders to monitor the markets they’re investing in. ATFX’s very own forex news calendar gives a complete breakdown of all the main economic and financial events and figures set to be released.

Currency Converter Calculate the foreign exchange rates of major FX currency pairs. Sometimes the number of current economic events https://forexhero.info/ can be overwhelming. So, first of all, make sure to use filters to see the most relevant indicators for your Forex trading.

The economic calendar includes information about major economic events, as well as political news and the impact they have on the Forex market. All these financial events are used as economic indicators. Our major economic events calendar is updated automatically as the reports come out.

What is the Economic Calendar?

Build your confidence and knowledge with a wealth of educational tools and online resources. Choose from standard, commissions, or DMA to get the right pricing model to fit your trading style and strategy. Our gain and loss percentage calculator quickly tells you the percentage of your account balance that you have won or lost.

None of the blogs or other sources of information is to be considered as constituting a track record. Any news, opinions, research, data, or other information contained within this website is provided as general market commentary and does not constitute investment or trading advice. FOREXLIVE™ expressly disclaims any liability for any lost bdswiss forex broker review principal or profits without limitation which may arise directly or indirectly from the use of or reliance on such information. As with all such advisory services, past results are never a guarantee of future results. Economic indicators are major economic events that are used to interpret investment opportunities in Forex trading.

In case the news is positive, i.e. its value is higher than the forecast median, a decision can be made to buy the currency, the quotes of which are most sensitive to the macroeconomic news content. Trade 5,500+ global markets including 80+ forex pairs, thousands of shares, popular cryptocurrencies and more. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey.

This economic calendar, powered by a trusted third-party, reveal the biggest financial news and events happening worldwide in real-time. Easy-to-use with filters to zoom in on the markets you care about most, this is a popular tool for fundamental analysts – as well as those who like to mix and match both fundamental and technical trading techniques. Forex market is influenced by a lot of factors and the key one is important economic news. Some traders in particular strive to trade during the periods when news and financial statistics are published, which are very essential for some specific industry development. In case the data from the Economic calendar is read and understood correctly, traders may get additional profit. Immediately after the news release and its evaluation in the economic calendar, the trader reconciles the released data with the forecast, and makes a decision to invest money according to the conclusions made.

It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary. BabyPips.com’s Economic Calendar is your trading companion to avoid event risk. Event risk is anything that will move markets, but that you can’t see coming. Use our economic calendar to inform yourself of important news events and economic data reports that may shake up the financial markets and impact your trading.

At the beginning of a new trading day , a trader opens the economic calendar and notes the important macroeconomic news. Of paramount importance is the news marked in the calendar with three exclamation points. Know ahead of time of upcoming economic data releases or events that may cause sudden volatility and negatively affect your trading, such as any open positions. Traders use the Financial calendar as a tool for fundamental analysis.

The Forex and stock market economic calendar summarizes news and other important publications to be published during trading sessions. These are the fundamental data that affect the prices of small and large markets. This is why the economic news calendar is one of the first-tier tools for real time analysis if you decide to trade foreign exchange. Economic calendar, also known as Forex economic calendar or FX Calendar, is a tool that allows traders to make the fundamental analysis of financial markets based on economic news. That is – you will be able to see macroeconomic events that move the market and make Forex trading decisions based on the data. Below are the main upcoming economic events and data releases, viewable with our ATFX live Forex news calendar.

CHANGE TIME ZONE

Seems like a simple fix and it would make tracking my account so much easier. I don’t use much else on the app so I can’t speak to that but it is nice to have your entire portfolio in one tracking app. The Fed’s preferred inflation measure has moderated in recent months, mirroring neural network xor the slowing CPI. Traders will want to see continued slowing to bid up risk assets and higher-yielding currencies. The Fed has made it clear that incoming inflation data will have a big saying in whether they will reduce the pace of tightening in the upcoming meetings.

What is an Economic (Forex) calendar?

GAIN Global Markets Inc. is part of the GAIN Capital Holdings, Inc. group of companies, which has its principal place of business at 30 Independence Blvd, Suite 300 , Warren, NJ 07059, USA. All are separate but affiliated subsidiaries of StoneX Group Inc. FOREX.com may, from time to time, offer payment processing services with respect to card deposits through StoneX Financial Ltd, Moor House First Floor, 120 London Wall, London, EC2Y 5ET. FOREX.com is a trading name of GAIN Global Markets Inc. which is authorized and regulated by the Cayman Islands Monetary Authority under the Securities Investment Business Law of the Cayman Islands with License number 25033.

FXStreet commits to offer the most accurate contents but due to the large amount of data and the wide range of official sources, FXStreet cannot be held responsible for the eventual inaccuracies that might occur. The Real-time Economic Calendar may also be subject to change without any previous notice. In addition to its unique importance for fundamental analysis and forecasting, as mentioned above, the Forex live economic calendar serves as an indicator for news trading in the Forex market. If you are engaged in exchange trading and seek advice regarding opening positions, the calendar can serve as a reliable source of information. Our economic calendar is your companion, a tab that is always opened on your computer.

Try a Demo Account Risk Free

Such data, if published, is able to channel the quotes of Forex market assets, stock and commodity markets into long-term trends. Such manifestations arise directly or indirectly, and fall into the domain of interest of investors who can use the economic calendar for long-term forecasting and investments. With time, you’ll be able to fine-tune your trading technique to benefit from the forex economic calendar and be up to date with the latest live events occurring around the globe. The real-timeEconomic Calendarcovers financial events and indicators from all over the world. The Real-time Economic Calendar only provides general information and it is not meant to be a trading guide.

The economic calendar shows each event in chronological order, as well as the time and date that each event is due to happen. You can filter dates by the day, week or month to see exactly what’s happening and when. In case you are experienced enough, they perform the analysis of previous macroeconomic data, as well as the reaction of the main market players and how it reflects in the dynamics of asset quotes. It is also important to get acquainted with the opinion of market experts and more experienced traders, get general market commentary and advice from independent experts on the Internet, including FXOpen blog.

Understanding How The Stock Market Works

Contents

NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty.

Going public also affords companies the ability to attract top talent with stock options and provide current employees with equity. These stock market indices track a large number of the top companies traded on a stock exchange. A broad market index, such as the S&P 500 or the Dow is a good representation of how the stock market is trending as a whole. People can’t just walk up to the New York Stock Exchange on Wall Street and buy or sell shares, though. When a stock is actually purchased or sold by the average person, it is done so through a brokerage. An Initial Public Offering refers to the process of offering shares of a private corporation to the public in a new stock issuance.

Stock market data may be delayed up to 20 minutes, and is intended solely for informational purposes, not for trading purposes. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. Here is a list of our partners and here’s how we make money. When someone says „the market is up“ or that a stock „beat the market,“ they are usually referring to a stock index. The Buttonwood Agreement, so named because it was signed under a buttonwood tree, marked the beginning of New York’s Wall Street in 1792.

The agreement was signed by 24 traders and was the first American organization of its kind to trade in securities. The traders renamed their venture the New York Stock and Exchange Board in 1817. Fair value can refer to the agreed price between buyer and seller or the estimated worth of assets and liabilities. Burdensome regulations may constrict a company’s ability to do business. The S&P 500 is a market-cap-weighted index of the 500 largest companies in the U.S. and is a much more valid indicator.

Alternative trading systems are venues for matching large buy and sell transactions and are not regulated like exchanges. Dark pools and many cryptocurrency exchanges are private exchanges or forums for securities and currency trading and operate within private groups. Most nations have a stock market, and each is regulated by a local financial regulator or monetary authority, or institute. The SEC is the regulatory body charged with overseeing the U.S. stock market. Having publicly tradable shares makes it easier to set up stock options plans that can attract talented employees.

Here’s a rundown on some of the most commonly viewed variables for stock analysis. Although stock trading dates back as far as the mid-1500s in Antwerp, modern stock trading is generally recognized as starting with the trading of shares in the East India Company in London. We work hard to ensure your equity orders are routed to destinations that have provided high-quality executions over time. We seek out top-performing securities exchanges and liquidity providers and rigorously evaluate execution quality. Get a better understanding of what stocks are and how you can incorporate them into your trading or investing strategy.

How Financial Markets Work

Overall, SPY and index funds like it deliver around a 9.5% return annually, which far exceeds any savings account, CD, or bond. If a nuclear bomb struck NYC, it’s near-certain that the market would crash substantially, whereas the money in your savings account will be worth the same it was before the event. There are also, as the chart depicts, extended periods where the index did not grow in value. In the event you suddenly needed to cash out your investments, the timing could result in a loss.

From do you have time for your internet marketing savings to college savings, from short-term goals to long, there really is an investment account for everything. The prices of different securities rise or fall, or both, throughout the day, every day the exchange is open. People make money by selling securities at a higher price than they paid for them. Our community of investors can answer your investing questions, helping you feel more secure as you start out. On Public Live, industry professionals offer commentary on the market and useful information for new investors. Find the stocks you want to buy on Public and specify the number of shares.

Every exchange has its own requirements that companies must meet to list their stock. The NYSE, for example, requires a minimum share price of $4 for an initial listing. In addition, the market value of a company’s publicly held shares must be at least $40 million, though some listings require $100 million. Knowing the basics of how stock markets work can help make you a better investor.

If an asking price and selling price match, the orders are filled. In large markets this can happen instantaneously, but in small markets it can take quite a while or not happen at all. When you invest in a company you are giving them a loan or buying a part of that company . When you invest in a company it may use the money to get bigger, purchase equipment, increase advertising, hire new people, research new products, or any number of other business activities. Your savings account provides you a safe place to keep your money and gain interest on it while you are not using that money. But the money in your savings account does not sit in a giant vault in the bank, it is used to help other people buy homes and cars and go to college.

The stock market is the best wealth creator in the entire world, yet remains a confusing concept for a lot of people. Whether you choose to work with an advisor and develop a financial strategy or invest online, J.P. Morgan offers insights, expertise and tools to help you reach your goals. JPMorgan Chase & Co., its affiliates, and employees do not provide tax, legal or accounting advice. Information presented on these webpages is not intended to provide, and should not be relied on for tax, legal and accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any financial transaction.

Premium Investing Services

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

The point of the https://business-oppurtunities.com/ market is to provide a place where anyone can buy and sell fractional ownership in a publicly traded company. It distributes control of some of the world’s largest companies among hundreds of millions of individual investors. And the buying and selling decisions of those investors determine the value of those companies. Stock prices on exchanges are governed by supply and demand, plain and simple.

Stock market indexes themselves are traded in the form of options and futures contracts, which are also traded on regulated exchanges. Domestically, the NYSE saw meager competition for more than two centuries, and its growth was primarily fueled by an ever-growing American economy. The LSE continued to dominate the European market for stock trading, but the NYSE became home to a continually expanding number of large companies. Stocks are an important part of any portfolio because of their potential for growth and higher returns versus other investment products.

How do you make money from a stock?

You can automate the process of investing, helping to keep your emotions out of the process. “Anytime the market changes we have this propensity to try to pull back or to second guess our willingness to be in,” says NewLeaf’s Madsen. You’ll have to study the company and anticipate what’s coming next, a tough job in good times. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

There may be more money to invest now, but the owners have to share decision making power and cash may still be limited. A partnership can also limit risk by making the business itself a legal entity. This way the business may be sued but the partners homes and money outside the business will be safe. If you’ve already maxed out your tax-advantaged retirement accounts or you’re ready to invest more than 15% of your income, you have a couple of additional options to keep investing for your future.

- You can choose strikes prices that are already lower than the current stock price .

- For example, if you own a broadly diversified fund based on the S&P 500, you’ll own stocks in hundreds of companies across many different industries.

- That signals that it will begin offering stock shares to the public.

- It enables the company to raise additional funds by issuing more shares.

„Chase Private Client“ is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking℠ account. Funding for education can come from any combination of options and a J.P. Morgan Advisor can help you understand the benefits and disadvantages of each one. Compare between 529 Plans, custodial accounts, financial aid and other education options to help meet your goals. From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst.

Supply and demand help determine the price for each security, or the levels at which stock market participants — investors and traders — are willing to buy or sell. This process is called price discovery, and it’s fundamental to how the market works. Price discovery plays an important role in determining how new information affects the value of a company.

It’s one part of an overarching financial system that affects everyday Americans. Fluctuations can impact everything from your job stability to your retirement accounts. When companies generate capital by selling stock, it fuels growth and expansion, which can create more jobs. As the market swings up and down, you’ll likely notice your investment accounts reacting in kind.

In fact, you’re already on step 3 of my investing plan for beginners. It’s also important to note that the stock market is not the economy, but it does affect the economy. The stock market is not actually a physical place of any kind, like the New York Stock Exchange.

Morningstar Pattern

Contents

The opposite pattern of the morning star pattern is the evening star pattern. This is a simple study designed to track multiple candlestick patterns. A morning star develops in a downward trend and marks the beginning of an upward rise. It indicates a reversal in the earlier price trend. Traders look for the emergence of a morning star before using further indications to verify the occurrence of a reversal. So, with this in mind, let us look at the step by step process of identifying the morning star candlestick.

And then I’m going to take, flip this over and sew down the other side. And I’m just going to put these two colors together. Alright so now we have these great blocks but they have these little points that are sticking out. So we’re going to use our ruler and we’re going to come straight up the side like this. And just trim those little points off right there.

The first candle shows that a downtrend was occurring and the bears were in control. However, after a tug-of-war and a period of uncertainty, the bulls successfully took over. You can expect increased stock prices to follow.

The Morning Star and Evening Star patterns are also relatively easy to spot and can be quite useful in identifying trend reversals. When you spot the pattern at a support level, you can use momentum oscillators like stochastic or RSI to confirm the reversal signal. An RSI rising from an oversold region following the formation of a Morning Star pattern around a support level confirms the bullish reversal signal. You can combine the Morning Star pattern with other technical analysis tools and indicators.

https://bigbostrade.com/ action traders use it as a signal to spot a buying opportunity in the market. An integral component of a technical trader’s toolkit is the morning star and evening star patterns. Morning and evening star forex patterns are very similar to each other. So my advice to you would be to know the patterns that we have discussed here. They are some of the most frequent and profitable patterns to trade on the Indian markets. As you progress, start developing trades based on the thought process behind the bulls’ actions and the bears.

Also, you could look at the overall volume to see whether it matches with the new trend. The importance of the morning star happens when the fourth candle opens above the body of the star candle. Spot an evening star with a doji instead of a spinning top in the middle? You’ve got a doji evening star, an even stronger signal of impending selling action. As for profit targets, a previous area of resistance or consolidation is generally a solid point to aim for. Make sure you pay attention to your risk/reward ratio here.

The https://forex-world.net/ candlestick pattern is the opposite of the Evening Star, which is a top reversal signal that indicates bad things are on the horizon. Also, Day 3 broke above the downward trendline that had served as resistance for MDY for the past week and a half. Both the trendline break and the classic Morning Star pattern could have given traders a potential signal to go long and buy the Midcap 400 exchange traded fund. This technical analysis guide covers the Morning Star Candlestick chart indicator. The pattern is split into three separate candles with relationships between all of them.

Dark Cloud Cover Candlestick Pattern: The Ultimate Guide

This is where Doji candles can be seen as the market opens and closes at the same level or very close to the same level. The indecision makes way for a bullish move because the bulls see value at this level and prevent any more selling. When the bullish candle appears after the Doji, then there will be a bullish confirmation. In a sideways market, the Morning Star pattern can be used to trade the price reversal from the support end of the price range.

When found in a downtrend, this pattern can be an indication that a reversal in the price trend is going to take place. What the pattern represents from a supply and demand point of view is a lot of selling in the period of the first black candle. Then, a period of lower trading with a reduced range, which indicates indecision in the market, forms the second candle. This is followed by a large white candle, which represents buyers taking control of the market.

Make sure the pattern is forming at the end of a downtrend or at the end of a consolidation period before trading it. The common consensus is that morning star patterns are a fair indication of market movement. They are also a helpful early candlestick pattern for technical traders just starting out because they are relatively easy to recognize.

What is the most powerful bullish candlestick pattern?

The morning star pattern is very simple to identify on the price chart if you are an intermediate trader. Even beginners can spot it easily on the chart with little practice. The pattern gives us well-defined entries and good risk-reward ratios. Despite this, it is advisable to combine this pattern with some other trading tools to increase reliability.

There are many seasonal tendencies in the markets that you can use to improve your trading strategies. For example, you will find that a lot of markets have some days that are more bullish or bearish than others. Each of the three candlesticks in the Three Black Crows pattern should be relatively long bearish candlesticks with little or no lower shadows. Each of these candlesticks mark a steady decline in the …

From a morning star pattern, traders should look to open long positions. The Morning Star is a bullish reversal pattern represented by three candles. During a downtrend, the first candle is long and decreases.

Psychology of Morning Star Candlestick Pattern

The chart above has been rendered in black and white, but red and green have become more common visualizations for candlesticks. The important thing to note about the morning star is that the middle candle can be black or white as the buyers and sellers start to balance out over the session. While both patterns can be useful in identifying potential reversals, it’s important to remember that they should not be used as the sole basis for trading decisions. Instead, they should be used in conjunction with other technical indicators to confirm the strength of the reversal signal. However, morning stars can also occur amid a downtrend, making them difficult to interpret.

- And I’m going to choose these two blues right here because they’re so pretty.

- Traders observe the formation of a morning star pattern on the price chart.

- On day 1 of the pattern , as expected, the market makes a new low and forms a long red candle.

- Morning Star is a bullish trend reversal candlestick pattern consisting of three candles.

- Since the doji candles of both days could easily be combined into one candlestick without any loss of information, the above chart is easily considered a morning doji star pattern.

Traditionally, a market is considered volatile when the ADX goes above 20 when used together with the standard length, which is 14. As such, buying pressure increases and makes it harder for bears to continue pushing prices lower. The market closes around where it opened, creating a Doji-like candle. When the market comes from the bearish trend, most market participants believe that it’s going to continue down.

Clients must consider all relevant risk factors, including their own personal financial situation, before trading. Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. Morning Star is a bullish trend reversal candlestick pattern consisting of three candles. So now we have to build the quarter of the block. And this star generally has a Y seam involved but we’ve made it so it doesn’t So then you’re going to take some background fabric, your black fabric. I mean you’re going to have to cut one or have four six inch blocks for each strip.

If the bullish move looks like it is continuing, then it might be time to trade. The typical method to trade a morning star is to open a buy position once you have confirmed that a bull run is actually underway. If you don’t confirm the move before trading, then there’s a chance the pattern could fail. If such a pattern appears and all other checklist items comply i.e volume, S&R, Risk Reward Ratio etc…I would go ahead and trade this confidently on the merits of an evening star. Morning star is a bullish pattern which occurs at the bottom end of the trend.

The Morning Star and Morning Doji Star are three day bottom reversal patterns. Just as the morning on earth predicts that the sun will rise, the morning star candlestick pattern suggests that prices will rise. The first day of the morning star pattern consists of a long bearish candlestick after a previous downtrend. The second day candlestick gaps down, therefore the candlestick opens at a lower price than the first day’s closing price.

Morning Star Candlestick: Trading Strategy for Forex Traders

Harness past https://forexarticles.net/ data to forecast price direction and anticipate market moves. From beginners to experts, all traders need to know a wide range of technical terms. Trade up today – join thousands of traders who choose a mobile-first broker.

How to Trade a Morning Star?

And I just can hardly wait to show you how to make it because this felt like a win for me. So to make this quilt you’re going to need one roll of 2 ½ inch strips. And we have used the Tonga Batiks Jubilee for Wilmington. And this roll works particularly well because there are two strips of each color and that’s what you need to make this quilt.

Числа Фибоначчи: цикл, рекурсия и Stream

Содержание

Значительную часть усвоенных им знаний он изложил в своей «Книге абака» (Liber abaci, 1202 год; до наших дней сохранилась только дополненная рукопись 1228 года). Эта книга состоит из 15 глав и содержит почти все арифметические и алгебраические сведения того времени, изложенные с исключительной полнотой и глубиной. Первые пять глав книги посвящены арифметике целых чисел на основе десятичной нумерации.

Инвестирование сопряжено с рисками потери денежных средств. Текущая доходность не является гарантией прибыли в будущем. Это можно и нужно использовать в своей торговой системе. Фибоначчи предлагает довольно точно искать эти уровни на графике. Осталось понять, нафига попу гармонь, если он не филармонь. Отношения соседних S-чисел Фибоначчи с абсолютной математической точностью совпадают в пределе с золотыми S-пропорциями.

В это время в кинотеатрах показывали фильм „Код да Винчи“. Я не намерен обсуждать качество, ценность и истинность этого фильма. Но момент с кодом, когда цифры стали стремительно прокручиваться, стал для меня одним из ключевых в этом фильме. Все элементы парка находятся в таких соотношениях, чтобы с помощью геометрического строения, взаиморасположения, освещения и света, произвести на человека впечатление гармонии и совершенства.

Числа Фибоначчи в языке программирования Python: как произвести расчет

— Прошу богоцентрировать весь процесс и направляю действие энергии числового ряда на активацию Божественных Часов. — Появился опять Саи Баба и предлагает выразить намерение о соединении Серебряной Струны с Часами. Ещё он говорит, что у тебя есть какой-то числовой ряд. Перед внутренним взором возникает образ Человека Леонарда да Винчи. Повторяющаяся последовательность в ряде Фибоначчи — 24 цифры.

- Парфенон — одно из красивейших зданий в Древней Греции (5 в. до н.э.) — имеет 8 колонн и 17 по разным сторонам, отношение его высоты к длине сторон равно 0,618.

- Вероятность продолжения тенденции всё равно больше, чем развитие контр движения.

- Считается, что об этом ряде было известно на Востоке, но именно Леонардо Фибоначчи опубликовал этот ряд чисел в книге «Liber Abaci» (сделал он это для демонстрации размножения популяции кроликов).

Применение связи и закономерностей золотого сечения, числа Фибоначчи можно найти не только в математике, но и в природе, в истории, в архитектуре и строительстве и во многих других науках. Одно число, поделенное на следующее через одно, покажет значение, стремящееся к 0,382. Во вселенной еще много неразгаданных тайн, некоторые из которых ученые уже смогли определить и описать.

У пифагорейцев эта фигура считается священной, поскольку является одновременно симметричной и асимметричной. Рост растений тоже происходит в соответствии с числовым рядом Фибоначчи – от ствола отходит ветка, на которой появляется лист, затем происходит длинный выброс и снова появляется листок, но он уже короче предыдущего. В этой картине, первый выброс равен 100%, второй 62%, а третий 38%(уровни Фибоначчи, используемые в торговле) и т.д. Числовой ряд можно выразить графически в виде раскрывающейся спирали. Можно отметить, что в природе имеется множество примеров, в основе которых заложена эта фигура, например, накатывающиеся волны, ушная раковина, строение галактик, микрокапилляры в организме человека и строение атомов. Свое открытие ученый сделал при подсчете планирования приплода кроликов по просьбе одного из дальних родственников.

Применение ряда Фибоначчи/последовательности/числа

Числа Фибоначчи и золотое сечение составляют основу разгадки окружающего мира, построения его формы и оптимального зрительного восприятия человеком, с помощью которых он может ощущать красоту и гармонию. Если мы проведём плавную линий через углы наших квадратов, то получим ни что иное, как спираль Архимеда, увеличение шага которой всегда равномерно. Разумеется есть золотой прямоугольник, золотой треугольник и даже золотой кубоид. Пропорции человеческого тела во многих соотношениях близки к Золотому Сечению. Заслугой Леонардо Фибоначчи является ряд чисел Фибоначчи. Считается, что об этом ряде было известно на Востоке, но именно Леонардо Фибоначчи опубликовал этот ряд чисел в книге «Liber Abaci» (сделал он это для демонстрации размножения популяции кроликов).

Хотя цикличность рынка и фондовых показателей действительно существует, на нее влияет множество факторов, которые невозможно предугадать строгими математическими законами. Некоторые природные процессы, такие как флуктуации в турбулентных потоках или вихревые процессы в атмосфере, можно приблизительно описать числами Фибоначчи. В культуреСветящиеся числа Фибоначчи от 1 до 55 прикреплены на дымовой трубе Turku Energia в Турку. В природеРасстояния между листьями (или ветками) на стволе растения относятся примерно как числа Фибоначчи. ООО «Современные формы образования» использует файлы «cookie», с целью персонализации сервисов и повышения удобства пользования веб-сайтом. «Cookie» представляют собой небольшие файлы, содержащие информацию о предыдущих посещениях веб-сайта.

Это представляет собой член(или элемент) ряда Фибоначчи. Два значения для x, полученных нами ранее, из которых одно представляло собою золотое сечение, являются собственными значениями матрицы. Поэтому, ещё одним способом вывода замкнутой формулы является использование матричного уравнения и линейной алгебры.

Однако, это соотношение иррационально, то есть представляет собой число с бесконечной, непредсказуемой последовательностью десятичных цифр в дробной части. Если же запросят 3-ий или какой либо последующий элемент последовательности Фибоначчи, то мы зайдем в цикл. Во временную переменную tmp сохраним следующее число последовательности. Когда пройдет нужное количество итераций, выведем значение cur в консоль.

Руставели «Витязь в тигровой шкуре» и на картинах художников. Согласно общепринятой версии, числа придуманы Леонардо Пизанским, легендарным математиком средневековой Европы. Сама последовательность была изложена в Книге Абака в 1202-м году в виде задачи по вычислению популяции кроликов. Рекурсивные функции обычно решают проблему, сначала найдя решение для подмножеств проблемы (рекурсивно), а затем модифицируя это «подрешение», дабы добраться уже до верного решения. В примере выше алгоритм sumCount сначала решает sumCount(value-1), а затем добавляет значение value, чтобы найти решение для sumCount. На этом я закончу историко-теоретическую часть и перейду непосредственно к финансовым рынкам.

Советы и хитрости применения уровней Фибоначчи